How to prepare for a financial statement audit

Proper preparation not only facilitates a smoother audit process but also minimises disruptions to daily operations and enhances the credibility of financial reporting

Preparing for a financial statement audit can be a daunting task for any organisation, whether large or small. An audit provides an independent assessment of a company’s financial statements, ensuring accuracy and compliance with accounting standards.

Proper preparation not only facilitates a smoother audit process but also minimises disruptions to daily operations and enhances the credibility of financial reporting.

Here’s a comprehensive guide on how to effectively prepare for a financial statement audit.

What steps to take

The first step in preparing for a financial statement audit is understanding the scope and objectives of the audit.

An audit typically involves a thorough examination of a company’s financial records, internal controls, and accounting practices to ensure that the financial statements present a true and fair view of the company’s financial position.

Auditors assess compliance with generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS), depending on the regulatory requirements. Understanding the audit’s scope helps in aligning preparation efforts with the auditor’s expectations.

Early planning is crucial for a successful audit. This involves setting a timeline for the audit process, identifying key milestones, and allocating responsibilities to team members.

Establishing a clear timeline ensures that all necessary tasks are completed in a timely manner, reducing last-minute rush and stress. Key milestones might include preparing and reviewing financial statements, compiling documentation, and conducting internal reviews. Assigning responsibilities ensures that team members are aware of their roles and can prepare accordingly.

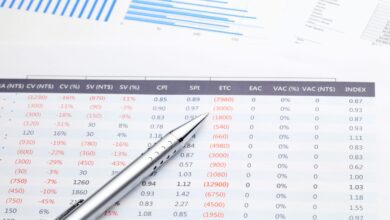

A critical aspect of audit preparation is ensuring the accuracy and completeness of financial records. This involves conducting a thorough review of all financial transactions and ensuring that they are properly recorded and classified.

Common areas to focus on include revenue recognition, expense classification, asset valuation, and liability assessment. Reconciliations of key accounts, such as bank statements, accounts receivable, and accounts payable, should be performed to ensure that balances are accurate and consistent with supporting documentation.

Internal controls play a vital role in the preparation for a financial statement audit. Strong internal controls help in preventing errors and fraud, and they also provide auditors with assurance about the reliability of financial reporting.

Companies should review and document their internal control procedures, ensuring that they are effectively designed and implemented. This includes controls over financial reporting, such as authorization of transactions, segregation of duties, and access controls. Performing an internal control assessment helps in identifying any weaknesses that need to be addressed before the audit.

Documentation is another key element in audit preparation. Auditors rely heavily on documentation to verify the accuracy and validity of financial information. Companies should ensure that all relevant documentation is well-organised and readily accessible. This includes supporting documents for all financial transactions, such as invoices, receipts, contracts, and bank statements.

Additionally, companies should maintain documentation of their accounting policies and procedures, as well as any significant judgments or estimates made during the preparation of financial statements.

Communication with the auditors is essential throughout the audit preparation process. Early and ongoing communication helps in understanding the auditor’s requirements and addressing any concerns or questions that may arise.

Companies should schedule a pre-audit meeting with the auditors to discuss the audit plan, timeline, and any specific areas of focus. Regular updates and meetings during the audit process ensure that both parties are aligned and that any issues are promptly addressed.

Preparing for potential audit adjustments is another important aspect of audit preparation. Auditors may propose adjustments to the financial statements based on their findings. Companies should be prepared to analyse and respond to these adjustments, providing additional documentation or explanations as needed.

This involves having a thorough understanding of the company’s financial statements and the underlying accounting principles. Being proactive in addressing potential adjustments helps in avoiding delays and ensuring a smoother audit process.

Training and educating staff about the audit process is also crucial. Employees involved in the preparation of financial statements and those who will interact with the auditors should have a clear understanding of the audit objectives and requirements.

Providing training sessions or workshops helps in ensuring that staff are well-prepared and can effectively support the audit process. This includes understanding the importance of accuracy, completeness, and timeliness in financial reporting and documentation.

Finally, companies should conduct a post-audit review to evaluate the audit process and identify areas for improvement. This involves reviewing the audit findings and recommendations, assessing the effectiveness of internal controls, and implementing any necessary changes to address identified weaknesses.

A post-audit review helps in enhancing the company’s financial reporting processes and preparing for future audits.

Preparing for a financial statement audit requires careful planning, thorough review of financial records, robust internal controls, effective documentation, and clear communication with auditors. A well-prepared audit not only meets regulatory requirements but also provides valuable insights into the company’s financial health and operational effectiveness, supporting long-term success.